Aug 2025 Market Commentary: Crypto Adoption Advances Across Assets and Policy

Author: Hillroute Date: Aug 28, 2025

Executive Summary:

1. Bitcoin, Ethereum & Altcoins

Bitcoin trades around $112K, supported by ETF-driven institutional demand and hedge appeal. Ethereum is up around 250% from April lows on ETF inflows and treasury adoption. Altcoins gained from ETF filings and corporate buys, with SBI launching Japan’s first dual-asset crypto ETF. Market stays neutral, though some tokens outperformed.

2. Institutional Expansion & Productization

Institutions are deepening their crypto push through treasuries, mining, and new products. Trump Media built a $2B Bitcoin treasury, added a $300M options strategy, and plans crypto ETFs and payments. Google took a 14% stake in miner TeraWulf, shifting its data centers toward AI and HPC with big revenue potential. Pantera invested $300M in digital asset treasury firms.

3. Regulatory Shifts & Institutional Pathways

Trump approved crypto in 401(k)s and stopped banks from blocking legal firms, supporting ETFs and access. SEC and CFTC set clear oversight rules. The Fed ended special crypto checks, easing banking. From Oct 2025, UK retail investors can trade crypto ETNs to stay competitive. Hong Kong’s new stablecoin rules enable cross-border use but add strict reserve and compliance demands.

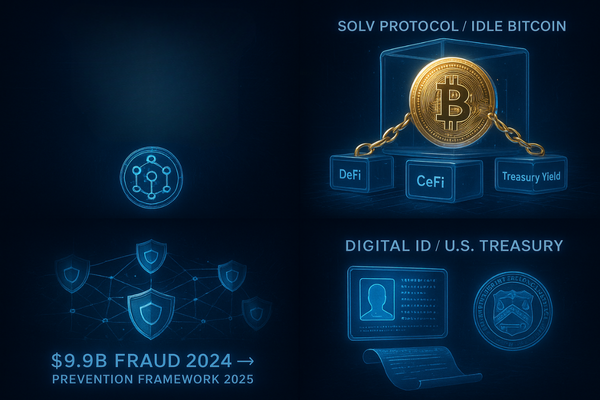

4. Security & Trust Infrastructure

Fraud losses of $9.9B in 2024 drive new UK data-sharing rules. The U.S. is exploring digital IDs in DeFi to improve compliance while keeping innovation.

Bitcoin, Ethereum & Altcoins

Bitcoin – ETFs, Mining Recovery & Macro Hedge Narrative

Bitcoin trades around $112K, with U.S. debt at $37T reinforcing its ‘digital gold’ narrative. Rising deficits and potential quantitative easing could fuel Bitcoin’s next rally.

Institutional Flows & Market Structure: Institutional Bitcoin demand now makes up 75% of Coinbase volume – outpacing new supply – with historical patterns and improving U.S. policy outlook providing bullish tailwinds for risk assets.

Key BTC Metrics :

Ethereum – ETF Momentum & Corporate Adoption

Ethereum has surged around 250% from its April low to August highs, trading around $4,556 and briefly touching $4,956 – its highest since November 2021. The rally is fueled by a dovish Fed, strong ETF inflows, and rising corporate adoption. SharpLink Gaming raised $200M to expand its Ethereum treasury beyond $2B in holdings.

Key ETH Metrics :

Altcoins – ETF Filings & Treasury Buys

Google searches for “Altcoin” and “Ethereum” hit multi-year highs, echoing past retail cycles. At the same time, U.S. regulators received 31 altcoin ETF applications in 2025, signaling rising institutional demand beyond Bitcoin and Ethereum.

- SBI Holdings filed Japan’s first dual-asset crypto ETF (Bitcoin + XRP) and separately launched the “Digital Gold Crypto ETF,” which combines gold ETFs with gold-backed cryptocurrencies.

- Cardano’s community has approved a $71M treasury allocation (96M ADA) to fund a 12-month development plan by Input Output Global (IOG).

Altcoin Market Metrics (as of 28 Aug 2025):

Institutional Expansion & Productization

Institutions continue to accelerate their crypto integration, with treasuries, mining, and custody driving this wave.

Trump Media’s $2B Bitcoin Treasury

- Acquired $2B in bitcoin and bitcoin-related securities (including ETFs, trusts, and derivatives) by end of July 2025.

- Allocated $300 million to an options-based BTC strategy.

- Total assets grew to $3.1B (+800% YoY).

- The company posted its first positive operating cash flow in Q2, generating $2.3M from media and tech operations.

Google Becomes Largest Shareholder in TeraWulf with 14% Equity Stake

- Google became TeraWulf’s largest shareholder (14% stake) after backing a $3.2B colocation lease deal with Fluidstack.

- The partnership is driving a strategic shift at TeraWulf’s Lake Mariner data center toward AI and high-performance computing (HPC) workloads, unlocking revenue potential of $6.7B–$16B.

Pantera Bets $300M on DATs

- Pantera Capital has deployed $300M into digital asset treasury companies (DATs) across the US, UK, and Israel, aiming for higher yields than crypto ETFs.

- These DATs hold major tokens including BTC, ETH, SOL, and employ strategies like staking, DeFi yields, and convertible bonds to grow assets per share.

Regulatory Shifts & Institutional Pathways

Trump’s Executive Orders: 401(k) Access & Anti-Debanking

- U.S. President Trump signed orders allowing crypto in 401(k) retirement plans and prohibiting banks from cutting off lawful industries, including crypto.

- Could channel billions into Bitcoin ETFs while easing banking frictions for exchanges and issuers.

SEC-CFTC Convergence

- SEC Chair Paul Atkins and the Commodity Futures Trading Commission (CFTC) outlined a shared oversight model: commodities under CFTC, securities under SEC.

- Shift from enforcement-led policy toward rule-based clarity, improving market trust and liquidity.

Federal Reserve Ends Special Crypto Oversight

- Fed shut down its special crypto supervisory program, returning oversight to standard bank regulation.

- Move removes a chokepoint narrative, potentially normalizing crypto banking access.

U.K. FCA Opens Retail Access to Crypto ETNs

- Starting Oct 8, 2025, retail investors can trade crypto exchange-traded notes (cETNs) on FCA-approved exchanges.

- Signals policy shift as overseas ETFs hold $146.4B AUM, pressuring the U.K. to stay competitive.

Hong Kong Stablecoin Bill Live

- HKMA (Hong Kong Monetary Authority) launches a stablecoin licensing regime, requiring approval for reserves, redemption, and AML standards.

- Opportunities in cross-border trade and B2B payments, though heavy reserve and compliance obligations could discourage smaller issuers.

Security & Trust Infrastructure

Data Sharing: The Next Compliance Frontier

- Crypto fraud hit $9.9B in 2024, exposing weak AML checks and fragmented anti-scam defenses.

- UK’s Data (Use & Access) Act 2025 sets stage for cross-sector data sharing, a model for global fraud prevention.

U.S. Treasury Explores Digital ID in DeFi

- Treasury consultation explores embedding KYC/AML in DeFi smart contracts under the GENIUS Act.

- Could establish a global precedent, balancing compliance integration with blockchain innovation.