June 2025 Market Commentary: Geopolitical Volatility Meet Institutional Resilience

Author: Hillroute Date: June 30, 2025

Executive Summary:

June 2025 tested crypto’s resilience, with Bitcoin pulling back from ATH amid geopolitical stress — yet institutional flows, regulatory clarity, and tokenization momentum stayed strong.

The Big Picture:

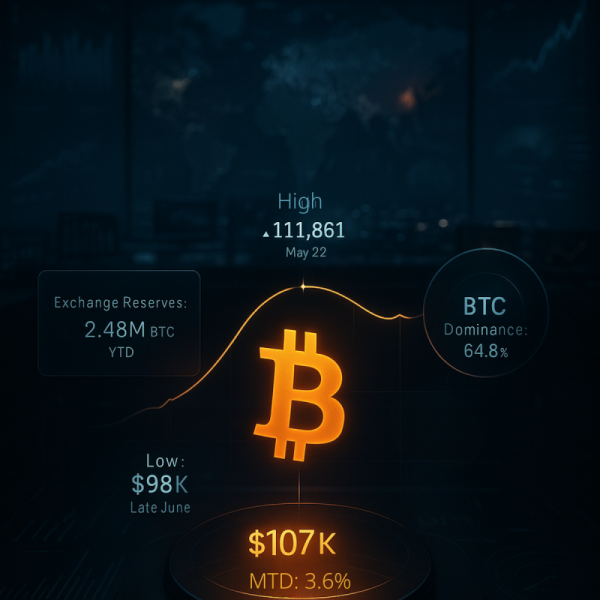

- Bitcoin: Peaked at $111.8K, dropped to $98K during Middle East-driven selloff, then rebounded to $107K (+3.6% MTD)

- Institutions: Investment advisers hold $10.3B in Bitcoin ETFs; interest in ETH ETFs is also rising

- Regulation: U.S. stablecoin bill passes Senate; MiCA licenses near for Coinbase, Gemini

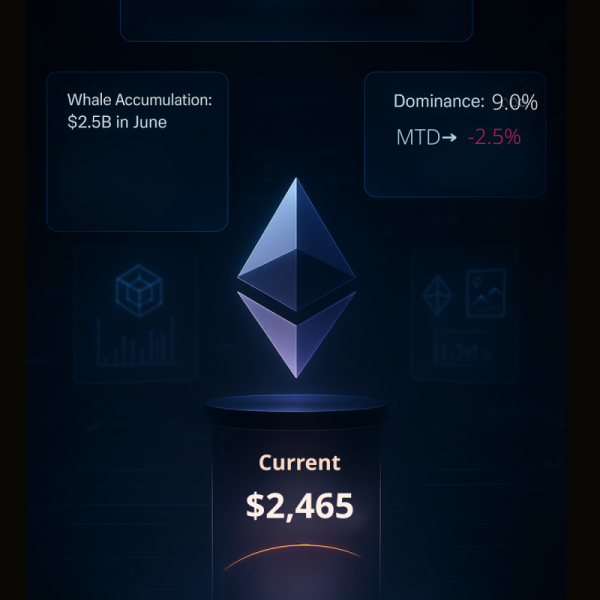

- Altcoins: Down 8–15% post-selloff; sentiment fragile but whale buying continues

- Infrastructure: Real-world assets gain traction — Tether, SocGen, Botanix advance deployment

- Security: $2.1B stolen YTD — attackers now target users over code

The path forward hinges on institutional allocation trends, regulatory execution, and macro stabilization.

Market Performance: Bitcoin, Ethereum, Altcoins

Bitcoin: The $111K Peak and Middle East Pullback

Bitcoin hit an ATH of $111,861 on May 22 amid strong ETF inflows, but geopolitical tensions in late June triggered a pullback to $98K. BTC rebounded to $107K, up 3.6% MTD.

Altcoins: Macro Pressure Caps Momentum

Altcoins declined sharply amid geopolitical escalation, with SOL, AVAX, LINK, and ARB falling 8–15%. TOTAL3 — the total market cap of all cryptocurrencies excluding Bitcoin and Ethereum — briefly dropped to $778B but rebounded to $830B, now down -1.6% MTD.

- Whale accumulation in SOL, LINK continues

- DEX volumes remain weak; CMC Altcoin Season Index at 19 (Altcoin Season >75) — still firmly in Bitcoin Season territory.

- CMC Crypto Fear & Greed Index at 52 — market sentiment remains Neutral

- Sentiment remains fragile, but early accumulation activity by whales and institutions in late Q2 signals positioning for a potential Q3 recovery — reflecting long-term conviction.

Institutional Adoption: Adviser-Led Allocation Deepens

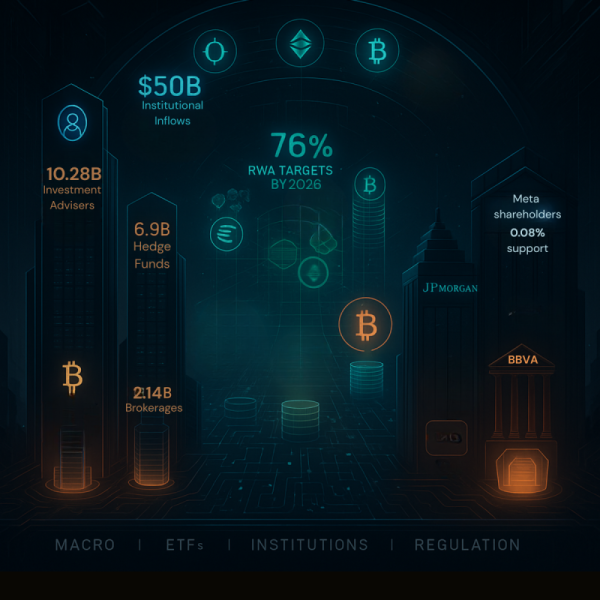

ETF Allocation Trends

Investment Advisers now hold $10.28B (124,753 BTC) in U.S. spot Bitcoin ETFs—nearly half of all institutional holdings—surpassing hedge funds ($6.9B) and brokerages ($2.14B). Ether ETFs are gaining traction, with $1.06B in institutional exposure, led by advisers at $582M (320,089 ETH). Analysts expect adviser-led allocations to grow to 35–40% of the ETF market.

Enterprise & Capital Trends

According to Coinbase’s latest “Crypto Asset Status Report“.

- 60% of Fortune 500 firms engaged in blockchain; avg. 9.7 projects per firm

- $50B institutional inflows into crypto funds in Q1; $3.5B to ETH

- 83% of institutional investors plan to increase their Crypto asset positions this year, and 59% of investors intend to allocate more than 5% of their managed assets to this field.

- The diversification trend is also expanding, with 73% of investors already holding tokens other than BTC and Ethereum, and 76% expecting to invest in tokenized real-world assets by 2026.

Bank & Political Engagement

- Spanish banking giant BBVA advises clients to allocate 3–7% to crypto post regulatory greenlight

- JPMorgan met with the SEC to discuss its blockchain plans and is testing JPMD — a digital version of bank deposits — on Coinbase’s Base network. This shows JPMorgan is getting more serious about using public blockchains for faster, on-chain money transfers.

- Meta shareholders overwhelmingly rejected a proposal to adopt Bitcoin as a corporate treasury asset, with only 0.08% voting in favor.

Political-Crypto Convergence

- Trump’s Truth Social files S-1 form for dual BTC/ETH ETF after approving a $2.3B corporate Bitcoin treasury allocation — this refers to Truth Social’s own corporate treasury, not a government treasury, signaling the company’s intent to integrate crypto into its balance sheet and investment strategy.

- CoinShares files 19b-4 with SEC to launch Solana ETF — its first proposed spot ETF beyond Bitcoin and Ethereum.

Regulation & Policy Shifts: Global Momentum, Political Friction

U.S. Developments

- The U.S. Senate passed the GENIUS Act (68–30), creating a legal framework for stablecoins — though some controversy remains due to Trump’s involvement in crypto.

- The Market Structure Clarity Act is under debate in the House, facing political disagreements that may delay its approval.

- Trump’s growing connections to crypto — including Truth Social’s ETF filings — have raised concerns about conflicts of interest and are adding tension to ongoing regulatory discussions.

Global Regulation Trends

- Thailand enacts 5-yearcrypto tax exemption effective Jan 2025; expected $30M impact

- Brazil introduces 17.5%flat crypto tax; ends exemption for small investors

- Gemini & Coinbase near MiCAlicensing—Gemini via Malta, Coinbase via Luxembourg

- Hong Kong to permit crypto derivatives trading for professionals, expanding $21T market access

Infrastructure & Tokenization: Real-World Assets Power a New Phase

Deployment-Stage Innovation

- Société Généralelaunched USD CoinVertible (USDCV) on Ethereum & Solana, backed by BNY Mellon—real-time USD/EUR settlement

- Tether acquired 32% of Elemental Altus Royalties ($89.4M)to back gold exposure via XAUt

- Galaxy & Fireblocksjoined Botanix Bitcoin Layer-2, supporting BTC-native DeFi

- Flare launched XRPFi, unlocking DeFi and staking for XRP; UK-based sustainable energy firm VivoPower pledged $100M to support the ecosystem, signaling cross-sector interest in blockchain infrastructure.

RWA Assurance & Legal Clarity

- Clear legal rules are now key to building trust in real-world asset (RWA) tokens — not just smart contracts.

- Tokens with detailed data are gaining popularity for better tracking and transparency.

- Singapore and Luxembourg have strong crypto rules, but are still not widely used by global projects.

Market Structure & Activity: U.S. Flow, Mining Power & Evolving Threats

Spot Flow & Exchange Trends

- Coinbase Premium hit a 4-month high of $109in June — strong U.S. demand signal

- 550K BTC (~$57B) withdrawn from exchanges YoY — 30% drop in liquid supply

- IBIT becomes fastest ETF to exceed $70B AUM, reinforcing regulated access channel preference

Mining Centralization & Growth

- U.S.-listed miners control 31.5%of global hashrate — highest ever

- Top 13 firms added 11 EH/s since April; network share rising post-halving

- Riot led H1 cap gains at +20%; Bitfarms lagged (–9%) despite strong capacity growth

Security Focus Shifts to Users

- $2.1Bstolen YTD — over $1B from phishing & social engineering

- Bybit’s $1.4B exploit remains largest in 2025, tied to Lazarus Group

- Security solutions must shift toward behavioral defenses and user risk mitigation